Real Estate & Taxes

Do I have to pay taxes on the profit I made selling my home? It depends on how long you owned and lived in the

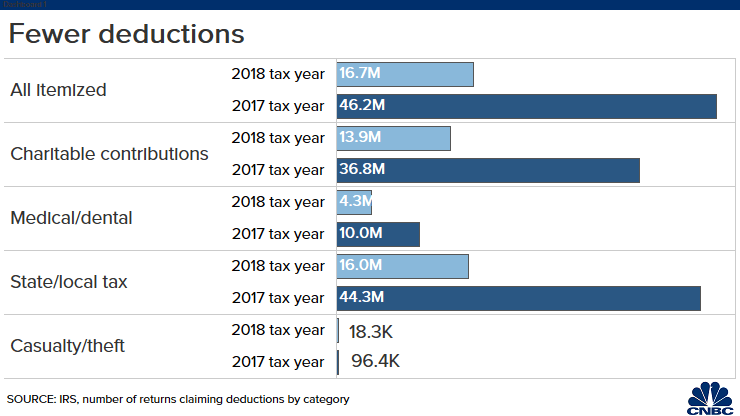

Millions of taxpayers missed out on a pile of tax write-offs when they filed their returns last year. In all, 16.7 million households claimed itemized deductions on their 2018 income tax returns, according to data from the IRS. That’s down from 46.2 million taxpayers during the 2017 tax year. The decline is the result of the Tax Cuts and Jobs Act, the overhaul of the tax code that went into effect in 2018. The change to the tax law roughly doubled the standard deduction that year to $12,000 for singles ($24,000 for married filing jointly), eliminated personal exemptions and curbed several itemized deductions.

While standard deductions reduce filers’ taxable income by a flat amount, itemized deductions allow you to lower taxable income based on the sum of different expenses you incurred – including charitable giving, state and local taxes, and casualty losses. When you file, you select whichever method reduces your taxable income the most. However, with the standard deduction so high in 2018, fewer people chose to itemize

Do I have to pay taxes on the profit I made selling my home? It depends on how long you owned and lived in the

Municipal bond issues are a very popular way to earntax-free income and, if income is reinvested, achievetax-free compounding of returns. Municipal bonds (also known as

This tax letter will bring tax planning challenges and opportunities brought by the CARES Act (2019) and SECURE Act (2020). Uncertain economic times provide opportunities

The Internal Revenue Service announced that the nation’s tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing